Chattel Mortgage Vs Lease - What’s the difference?

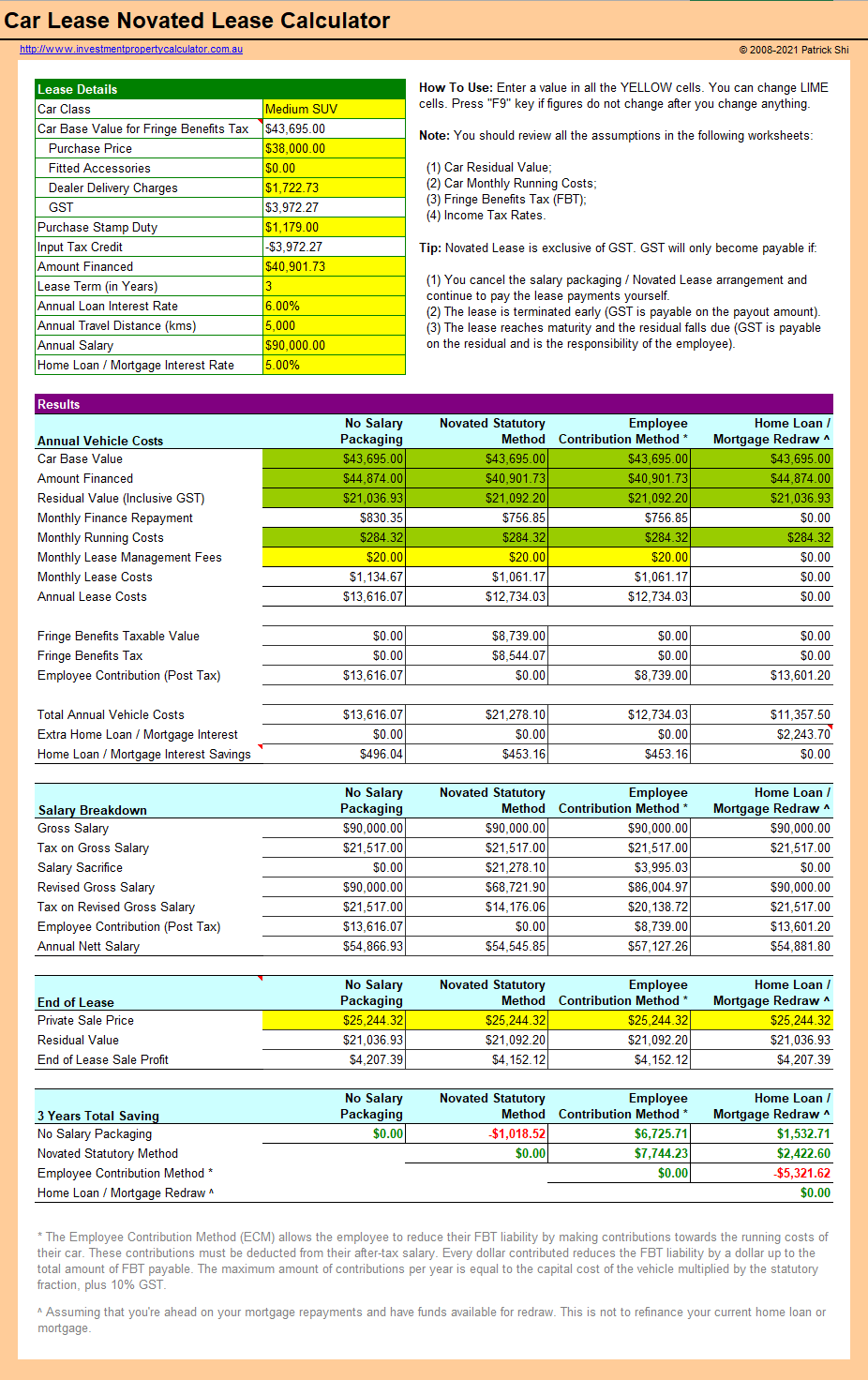

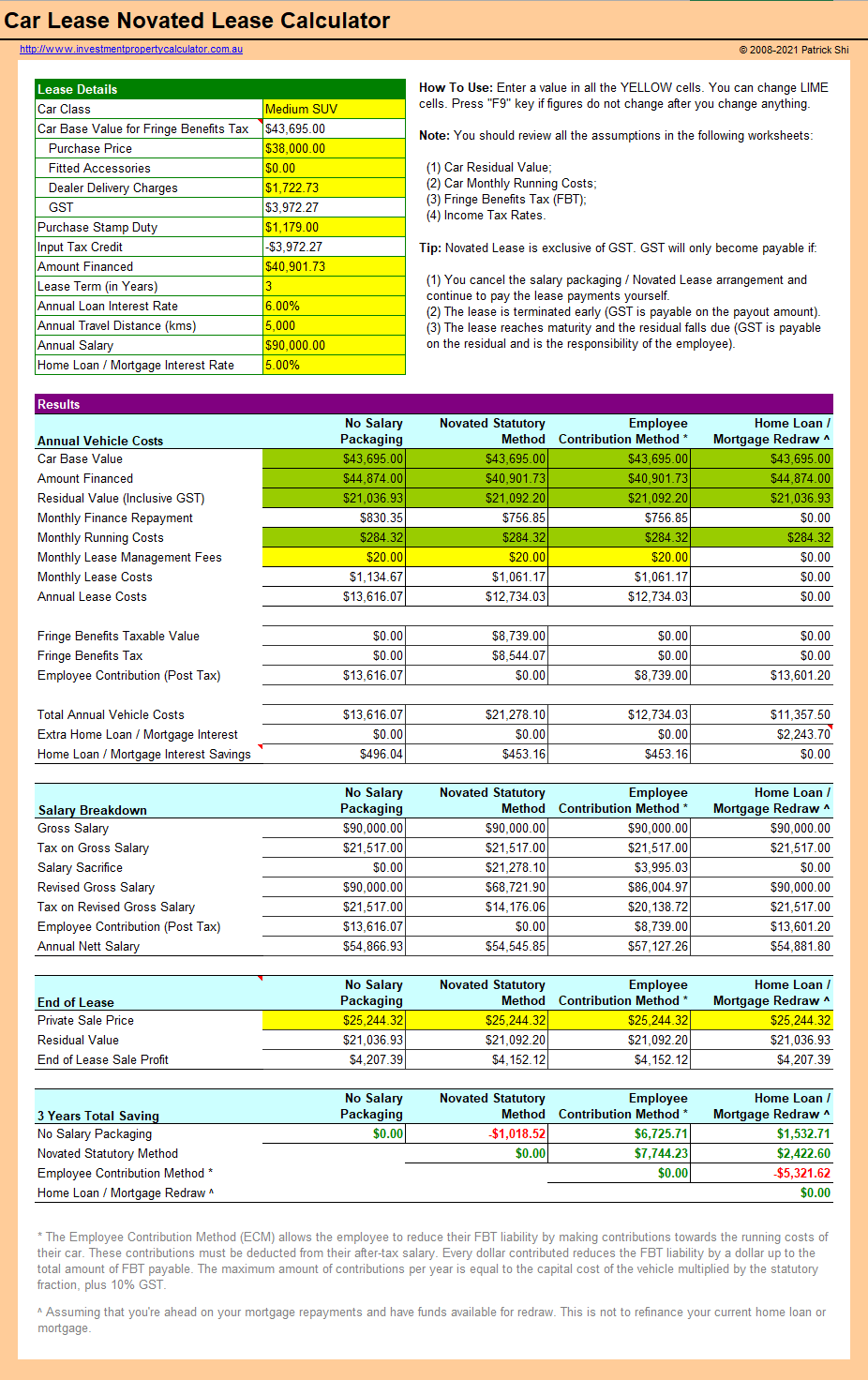

Having extra cash to purchase commercial vehicles outright is a luxury most businesses can’t afford. That’s why many lenders and dealerships offer a range of financing options to facilitate equipment finance purchases – these can help ease cash flow and allow you to afford a better, more reliable and useful vehicle Novated Leasing Calculator.

There are also a number of tax benefits involved with purchasing a vehicle for business purposes. You’ll normally be able to deduct things like loan payments, running costs and Fringe Benefits Tax (FBT) from your pre-tax income. You might also be able to get tax deductions for depreciation and claim GST on the initial purchase.

When you've decided on how much to spend on a car and are purchasing a new or used vehicle for your business each finance option available has its own unique characteristics that will impact your business. When searching around you’ll most likely encounter the terms chattel mortgage, finance lease, novated lease and operating lease as these are some of the most popular finance options. In this article, we’ll explore exactly what each of these options involves, as well as their pros and cons, so you can make a well-informed decision.

Choosing the best finance option for your business

When you’re choosing between a chattel mortgage or a lease, there are a number of factors that should influence your decision:

A chattel mortgage is a commercial loan product and works in the same way as a fixed-rate traditional mortgage. The lender will use your car as security against the loan, and you’ll effectively have ownership over the vehicle right away. By comparison, a lease is a long-term rental agreement, and you normally won’t ever have ownership of the vehicle.

What is a Lease?

In broad terms, a lease is a contractual arrangement calling for the lessee to pay the lessor for use of an asset. Property, buildings and vehicles are common assets that are leased. There are three main types of vehicle leases: finance leases, novated leases and operating leases.

A finance lease is where you pay a lender to use the vehicle, much like a long-term rental agreement. The lessor takes the risk on the purchase and resale of the vehicle, and it frees up your business capital that may otherwise be tied up with ownership of the asset. Your business will then pay monthly instalments, or rental payments, for the duration of the lease period. At the end of the lease, you’ll have the option to either pay out the residual value of the vehicle or return the asset with no resale value risks.

A novated lease is a unique employee-benefit arrangement that involves you, your employee and a financier, and can last between one and five years.

It’s a form of ‘salary packaging’ that helps finance new or used vehicles by repayment obligations made from an employee's pre-tax salary. This can effectively reduce your taxable income and also can allow you to bundle your vehicle’s expenses into one simple payment.

An operating lease is a rental agreement used to finance a vehicle for less than its useful life, with the vehicle able to be returned to the lessor at the end of the lease period without any further obligation.

Operating leases generally have a shorter term than the other popular types of leases, so you are able to upgrade to a new vehicle regularly. You may even be able to do this whilst the lease is still active. One of the main differences between an operating lease and a finance lease is that with an operating lease, the user will not be able to buy the vehicle at any point throughout the lease.

When it comes to car finance, a chattel mortgage is a very popular option among business owners and operators. A chattel mortgage has a similar structure to a fixed-rate traditional mortgage whereby the finance provider uses the vehicle as the security for your car loan. Chattel refers to the car or equipment, and mortgage refers to the loan.

Unlike a lease, a chattel mortgage gives you ownership of the vehicle right away and you then pay off the loan from the income the asset generates in your business. If you’re unable to meet your monthly repayments, your finance provider may be able to repossess your vehicle.

You’ll be able to claim GST on the initial purchase price of the vehicle, as long as your business is registered for GST. The maximum amount of GST you can claim on your vehicle is 1/11th of the cost limit that is set by the ATO. For 2021-22, the maximum GST credit available to claim is $5,521.

What happens at the end of a chattel mortgage?

After you’ve made your last loan repayment and any residual value (the final balance on

|